Netflix released its earnings in mid-July, revealing a modest improvement in its financial situation. Just 12 months ago, Netflix faced a concerning decline in value, marked by decreasing subscriber numbers, questions about its fundamental business models, and increasing competition. However, by July 2023, Netflix's stock has rebounded, climbing over 50% this year despite a broad labor strike and a halt in production.

The company has also emphasized positive numbers in its earnings call, such as the revenue growth in all regions after the launching of paid sharing, a signal that sign-ups are already exceeding cancellations. However, when it comes to demand for original and on-platform content, Netflix continues to lose ground to its competition.

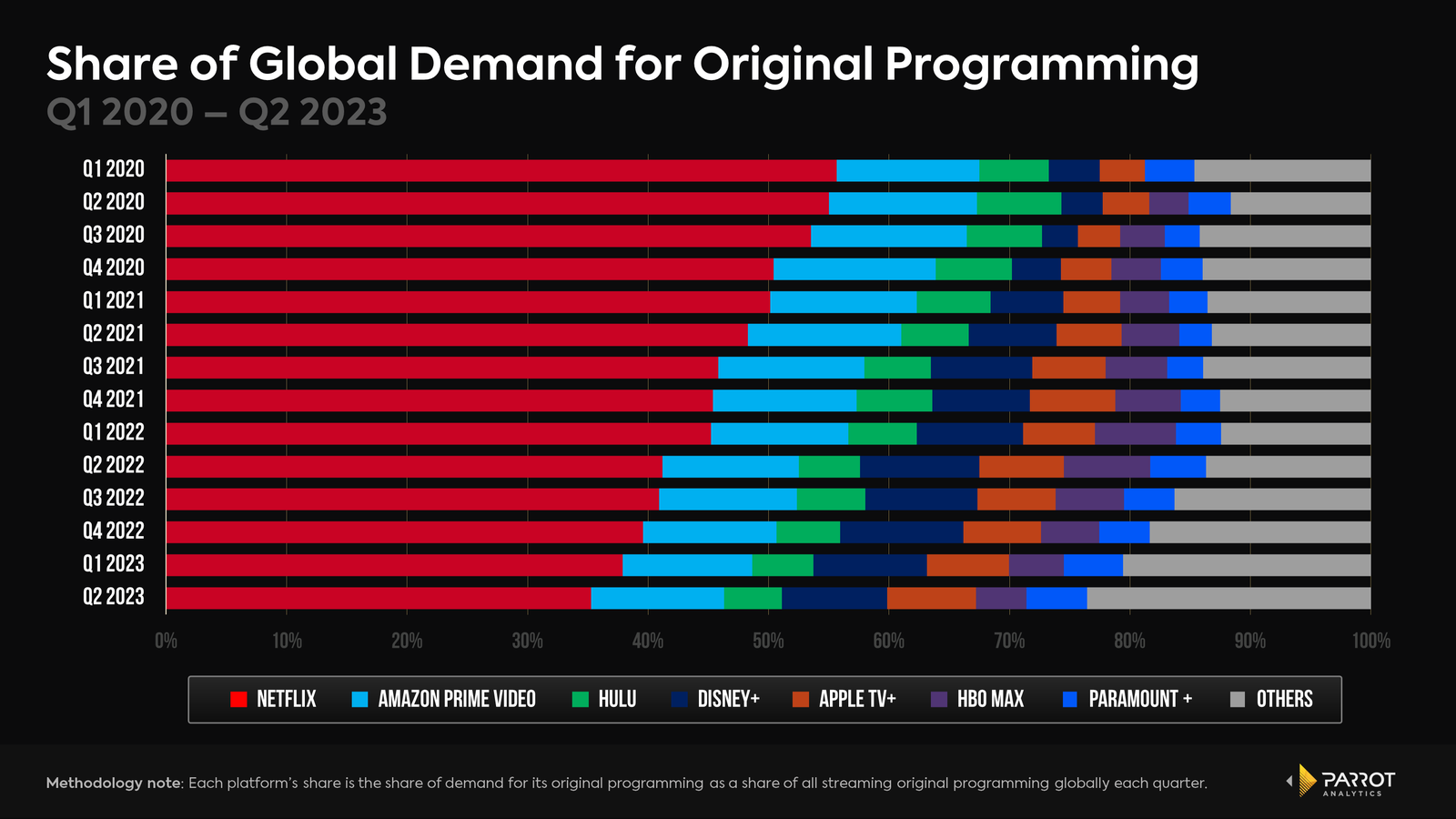

Over the past three years, Netflix’s global share of demand for original series has steadily eroded, reaching a record low of 35.3%. Although it remains the leading player, this marks a nearly 20 percentage point drop from three years ago when it accounted for 55.0% in Q2 2020. In contrast, both Apple TV+ and Paramount+ reached record highs in global demand share in Q2 2023, at 7.4% and 5.0% respectively.

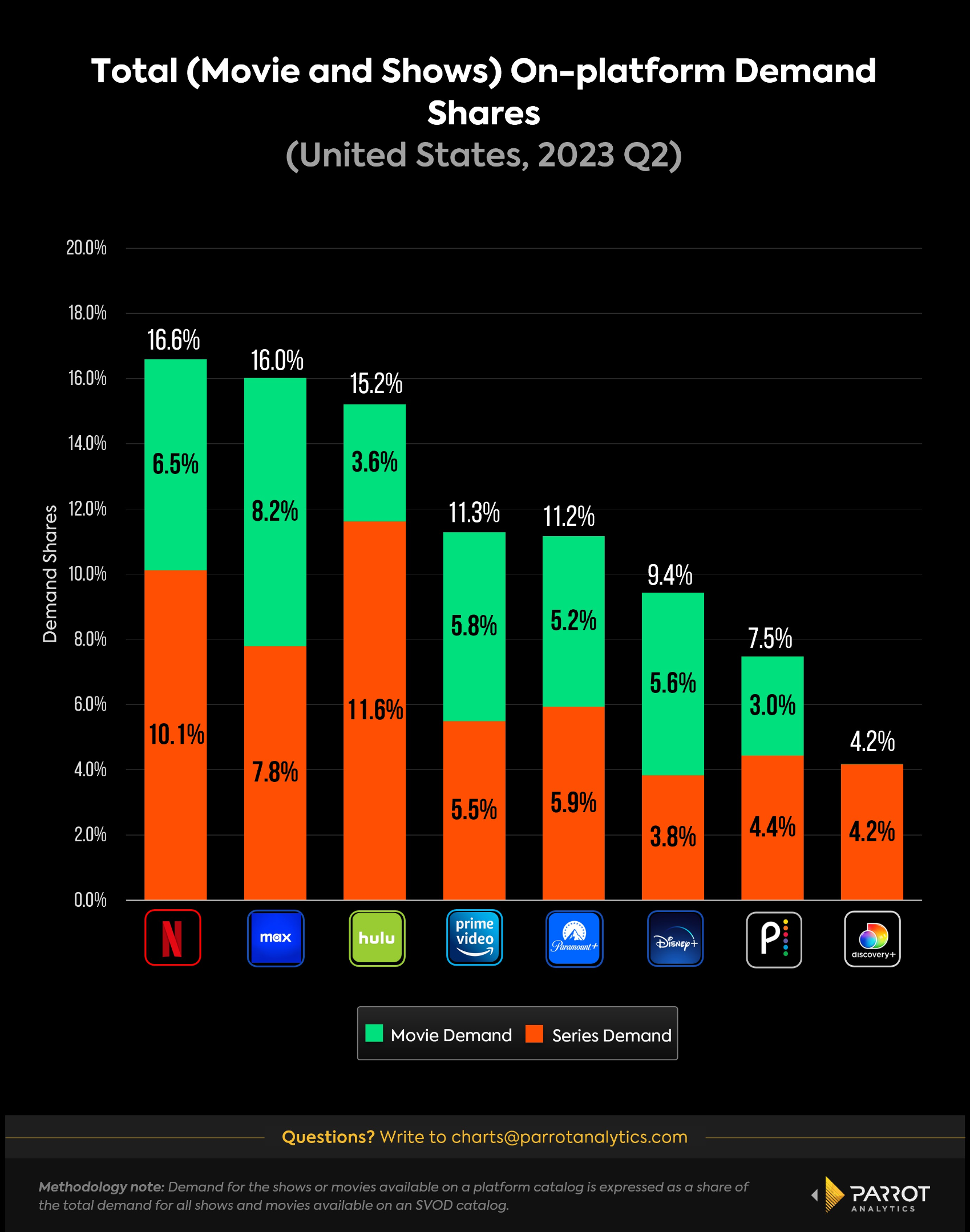

While original content fuels subscription growth, library content plays a vital role in retaining customers. This is becoming increasingly important in the streaming landscape as consumers now have more choices and find it easier to cancel subscriptions. Netflix still holds the top spot in on-platform demand share in the US market, but its lead has narrowed significantly this quarter. This is largely attributed to the relaunch of 'Max,' now enriched with much of the Discovery+ catalog. In Q1 2023, Netflix led with 17.9%, a 2.1% advantage over Hulu’s 15.8%. Currently, Netflix's lead over Max has been trimmed to just 0.6%, at 16.6% to 16.0%.

Netflix's dominance is further threatened by other players such as Disney, which has unveiled plans to merge Hulu and Disney+ in some capacity. The total on-platform share of the combined platform would cater to nearly a quarter of all content demand among US consumers. Despite the inconsistency, Netflix remains Wall Street's favored entertainment media stock. If the advertising tier continues to grow and efforts to prevent password-sharing bolster revenue, Netflix may secure its position as the most profitable premium streamer in the industry, even as its rivals face uncertainty.